How I Paid Off a $50K Private Student Loan

Ok first things first!! THANK YOU, JESUS!!!! I feel so relieved to not have this student loan haunting me anymore! I don’t have a fail proof system nor did I follow any financial gurus’ steps. I came up with my own way of doing things and it worked for me! Let me also start by stating I know not everyone will be able to do things the way I did them because of some of the blessings God was able to give me along the way. Ok now that all of that is out the way, here it goes!

So when in college at The Great (but expensive) Bethune- Cookman University, I took out a few private loans (as well as federal) that helped me to get through school and give me a nice refund check to live off of throughout the years. 1 out of 10 do not recommend at all. I would never and will never recommend student loans to anyone. If I knew then what I know now, I would have done things completely different. I just know my kids won’t have any student loans, but life happened for my family and student loans were needed!

So let’s fast forward, I consolidated all those loans and it left me with a balance of $52,008. Baby that monthly payment was $500 and I did not like it so I refinanced and was able to get a better rate but only saved about $100. My new payment was $396.26! In 2018, I sold my home and moved back to Florida to live with my mom because I was traveling every week for work and wanted to get serious about being debt free. It didn’t make any sense for me to be paying mortgage and utilities on a home I was only living in for 2 full days a week. The equity on my home afforded me the opportunity to pay off my car, all my credit cards, take a few trips and splurge on myself a bit and it left me with $10,000 to put into a high yield savings account. I originally planned to use this savings account to start saving for another home once I finally decided to stop traveling full time for work but I had a strong conviction to go into my next home with little to no outside bills or debt. So that’s when the journey to pay off this $50,000 loan began. I needed $40,000 more dollars!!

Honestly, I would have been had the 40K, but I was notorious for dipping into my savings account and using it for travel, entertainment, and anything my heart desired. It became my safety net and crutch and was also giving me an excuse to not stick to my budget because hey if I went over, I have all this money sitting here to make up for it!!! Definitely not the move at all!! Once I buckled down and got serious my account grew and I loved seeing such high numbers. So here’s how I ddi it!

Every time I paid something off, I added that amount to my savings amount similar to the debt snowball method. So I started with saving $650 which was my mortgage payment (why did I sell that house? Lol ) then I paid off my car and with that payment added, my savings amount increased to $950. I moved my savings to American Express Personal Savings Online Bank so it wouldn’t be so easy to transfer funds to my checking account. I also set up my direct deposit for work to have my savings amount automatically go into my high yield savings account so I wouldn’t even see or have an opportunity to not transfer the full amount because I know myself!!! As more things started to get paid off and as my salary increased I was able to re-work my budget and I was saving $1200 per paycheck ($2400 a month) because let’s face it my mom is amazing and I didn’t have to pay any rent. But of course I do and did help out! Also every year my job gives bonuses, it took everything in me to have those bonus checks go directly to my savings account after paying my tithes! Also anytime I received a raise the difference between the new and old pay would automatically go to my savings each month.

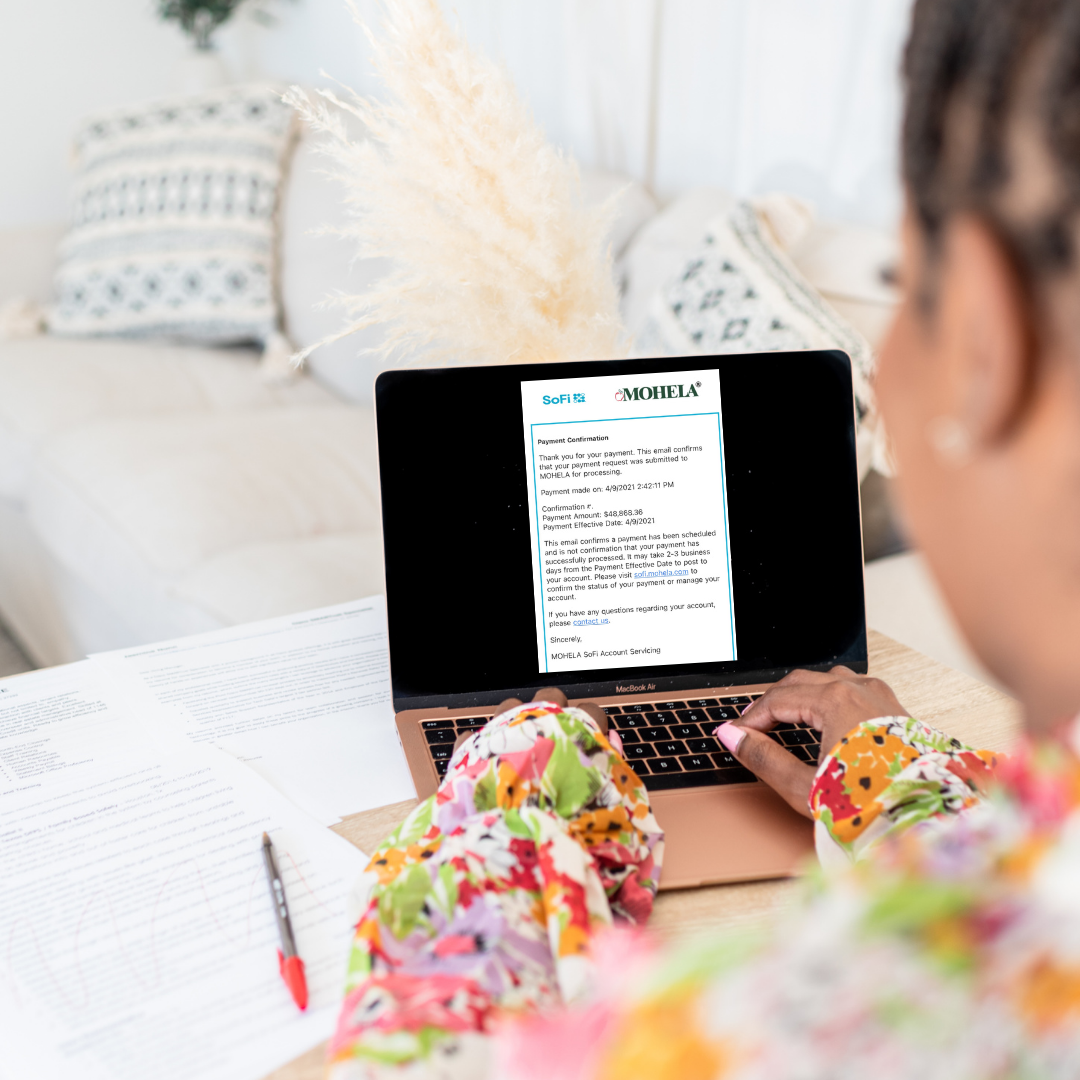

I continued to pay the $396.26 each month as I was saving, and I gave myself until May 2021 to have this loan paid in full!! I am happy to report that on April 9,2021 I made the call and was able to make a payment of $48,848.38. I am soooo very relieved but now it’s time to build my savings back up and get this house! So I plan to have $50,000 saved again by this time next year! It will require loads of discipline, but I am ready for the challenge! I have received a raise and also added the $400 student loan payment to my savings amount so now I am saving $1500 per check ($3000 per month) which I might up to $1600 ($3200 per month) depending on how I like my budget after this next paycheck.

I hope you found this article helpful and know that it takes a lot of sacrifice to be able to save like this. Some sacrifices I am not always willing to make and do dip from time to time but hey I am human I’d be lying if I said it was easy or that I stuck to the plan 100% of time! I am always for rewarding yourself from time to time! All glory is given to God because I know without him none of this would have been possible. If you have any questions, feel free to email them below and maybe we can come up with a savings plan for you together! Until next time!

Peace and Love,

Jasmine Kaye